Altair Payroll

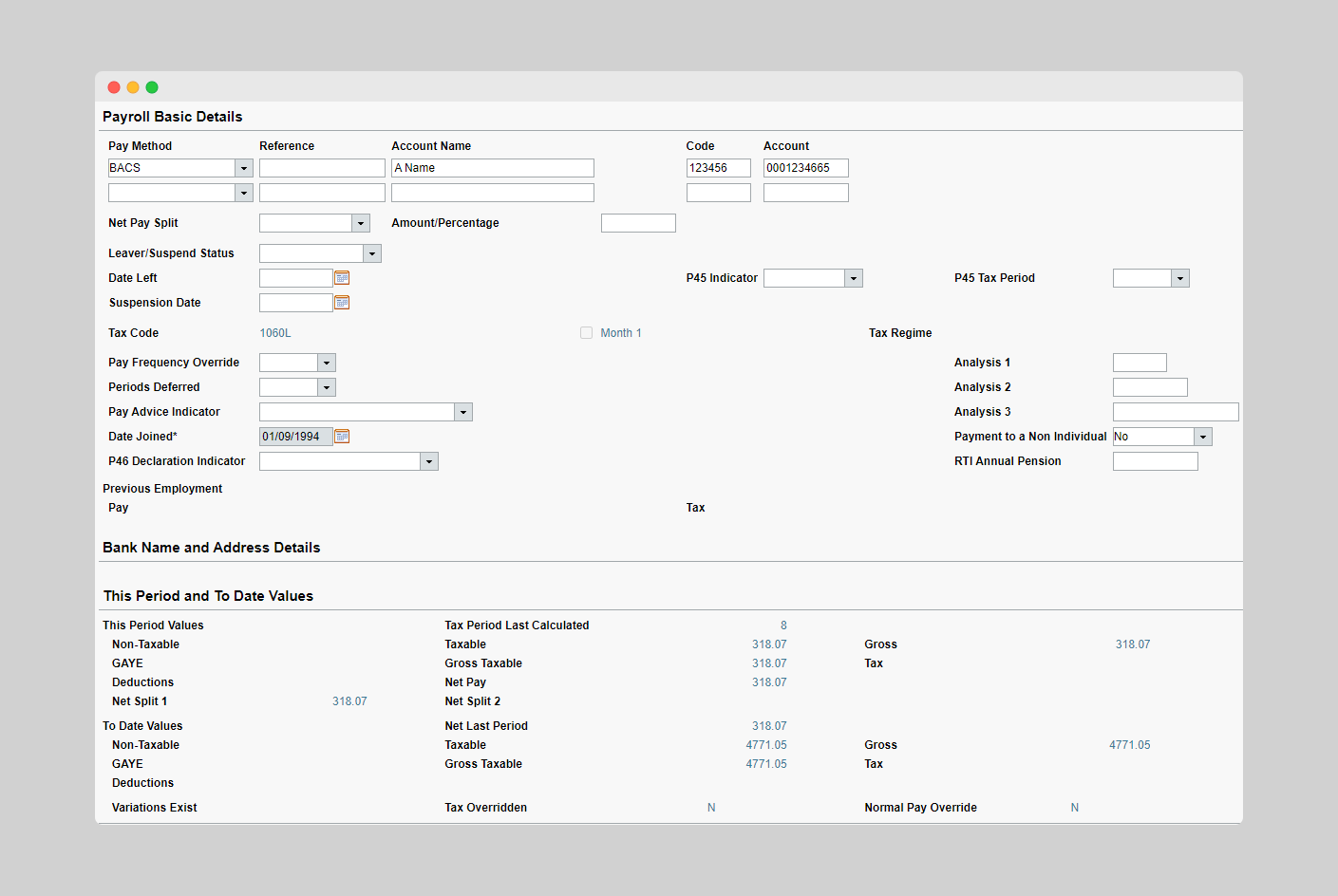

Robust payroll management

Altair Payroll is trusted to process over 20 million payments every year, and ensures full compliance at every step. With real-time payroll and tax reporting, it’s always got you covered.

Altair Payroll is an integral module within the Altair ecosystem. This means you don’t just get a comprehensive retiree payroll system. Plus the benefits of seamless integration with Heywood’s member engagement platform and Heywood Insights.

Integration. Compliance. Efficiency.

- Seamless integration

Altair Payroll offers effortless integration with Altair, utilizing a single database for both administration and payroll data. - Complete compliance

Ensure compliance with US Federal and State tax withholding regulations, including support for IRS reporting requirements such as 1099-R forms and integration with tax authorities. Altair Payroll supports adherence to all applicable US pension payroll legislation. Enhanced efficiency

Boost operational efficiency with automated payroll processing, including multiple payment types and frequencies. The system supports off-cycle and immediate payments, third-party deductions, and generates audit trails and control reports to streamline pensioner payroll management.

Case Study: Clwyd Pension Fund

Find out how a pension plan has taken advantage of Heywood’s Enhanced Admin to Pay Solution to make it easier for members to receive their benefits.

Read the case studyReasons to choose Altair Payroll

Single database, securely hosted in North America

Automated data transfer

Simplified processes

Professional support

Altair

Fully integrated. Fully compliant.

The system is built to ensure compliance at every step. Altair Payroll supports timely reporting to US Federal and State tax authorities, including 1099-R generation and EFT processing, helping you save time while staying compliant.

- Pensions Operations Manager & Senior Pensions Officer

.png)

Latest insights and resources

Giving you the insider view on all the latest industry developments, and expert intelligence on the news that matters.

Regulation

ADA Title II and public pension plans: What the April 2026 deadline means for your digital services

.png)

Pension software

Heywood selected by San Joaquin County Employees’ Retirement Association to deliver modern pension administration platform

Pension software

Reflections from SACRS: collaboration at the heart of public pensions

Who we work with

Other pension administration and software solutions from Heywood

Heywood Engage

Heywood Video Engage

Turn regular financial communications into

genuine understanding. Simplify complex financial data into clear, engaging, personalized video experiences to engage your members like never before.

Heywood Insights

Heywood Insights is a rich and intuitive business intelligence platform that seamlessly integrates with your pension plan's data.